contra costa sales tax increase 2021

2021 - Quarter 4 Not yet released 2021 - Quarter 3 Not yet released 2021 - Quarter 2 PDF 2021 -. Triple Flip Unwind PDF Sales Tax Primer PDF 2021.

Property Taxes Department Of Tax And Collections County Of Santa Clara

San Mateo Co Local Tax Sl.

. The sales tax would be collected in the incorporated and unincorporated areas. Single Life Annuity With 10 Years Guaranteed. A no vote opposed authorizing an extension and increase to the current sales tax from 05 to 1 generating an estimated 27 million per year for city services including emergency response disaster preparedness local businesses street repair gang prevention law enforcement and addressing homelessness thereby leaving the existing total sales tax rate in Concord at 875.

The Contra Costa County Sales Tax is collected by the merchant on all. Contra Costa County California Sales Tax Rate 2022 Up to 1075. The Contra Costa County sales tax rate is.

The salesuse tax rate varies throughout California and is higher than the current state rate of 725 percent. Number One Chinese Restaurant Toronto. 11 Building 17 BusInd.

The leading industry groups of total taxable transactions for Contra Costa County are General Consumer Goods 30 Autos and Transportation. Best Dining In Melbourne Fl. Raised from 925 to 9375 San Francisco.

Contra Costa Countys Measure X was ahead Wednesday morning 59 to 41 in semi-official election results with a majority needed to pass. The Contra Costa County Sales Tax is 025. The December 2020 total local sales tax rate was 8250.

Contra Costa County Sales Tax Increase 2021. 7 ConsGoods 7 FoodDrug 16 Fuel ADJUSTED FOR ECONOMIC DATA 4Q 2020 CONTRA COSTA COUNTY SALES TAX UPDATE STATEWIDE RESULTS The local one cent sales and use tax from sales occurring October through December the holiday shopping. Are Dental Implants Tax Deductible In Ireland.

Contra Costa County California Sales Tax Rate 2022 Up to 1075. That would bring Contra Costas sales-tax rate up to around 10 percent. To the Contra Costa countywide increase of 050 percent listed in the countywide table.

If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine. Proposition 172 Sales Tax Revenue Increase Projected Increase in Proposition 172 Revenue. You can see a list of all cities with tax increases in effect.

It was approved. Food sales are exempt and the county estimates the tax would raise 81 million a year for the general fund. Restaurants In Matthews Nc That Deliver.

To the Contra Costa countywide increase of 050 percent listed in the countywide table. Concord voters will consider measure v which also would continue and increase an existing sales tax from 05 to 1. This is the total of state and county sales tax rates.

Whereas Alameda County sales tax for 2021 increased 975 over 2020. Contra Costa County Sales Tax Increase 2021. The minimum combined 2022 sales tax rate for Contra Costa County California is.

A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. San Mateo County District Tax. The measure adopts a 05 sales tax for 20 years beginning April 2021.

Contra Costa County Measure X was on the ballot as a referral in Contra Costa County on November 3 2020. Contra Costa County Office of the Sheriff 1 FY 2021-2022 RECOMMENDED BUDGET. Majestic Life Church Service Times.

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. More on Measure X. The report is for the citys Fiscal Year 202021 which ended last June 30.

For fiscal year 2021 Contra Costa County sales tax increased 1475 over fiscal year 2020. Over the past year there have been 58 local sales tax rate changes in California. Opry Mills Breakfast Restaurants.

City of Concord located in Contra Costa County 8750. The Contra Costa Board of Supervisors is likely to levy a 20-year half-cent sales tax proposal on the November ballot to make health and other critical resources more accessible and available. City of San Rafael located in Marin County 9000.

Riverside County Tax Collector California. To keep Contra Costas. The measure adopts a 05 sales tax for 20 years beginning april 2021.

The minimum combined 2022 sales tax rate for Contra Costa County California is. Registered voters approved measures to charge new or extended existing salesuse tax rates to residents within specific jurisdictions beginning April 1 2021. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Restaurants In Erie County Lawsuit. Uninc This Quarter 27 Pools 7 Restaurants 7 AutosTrans. The California state sales tax rate is currently.

2 days agoAt the beginning of Tuesday nights Antioch City Council meeting the Sales Tax Citizens Oversight Committee for Measures C and W will present their 8th Annual Report on the revenue and expenditures of the current 1 sales tax approved by the voters in November 2018. Some cities and local governments in Contra Costa County collect additional local sales taxes which can be as high as 45. That would bring Contra Costas sales-tax rate up to around 10 percent.

A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety. Following last years passage of the 20-year-long half-cent sales tax measure the Measure X advisory board was formed in February to make recommendations to the Contra Costa County Board of Supervisors on how to best prioritize and allocate funds from the tax. 7 The city approved a new 100 percent SBNT to replace the existing 025 percent SBRN which will expire March 31 2021.

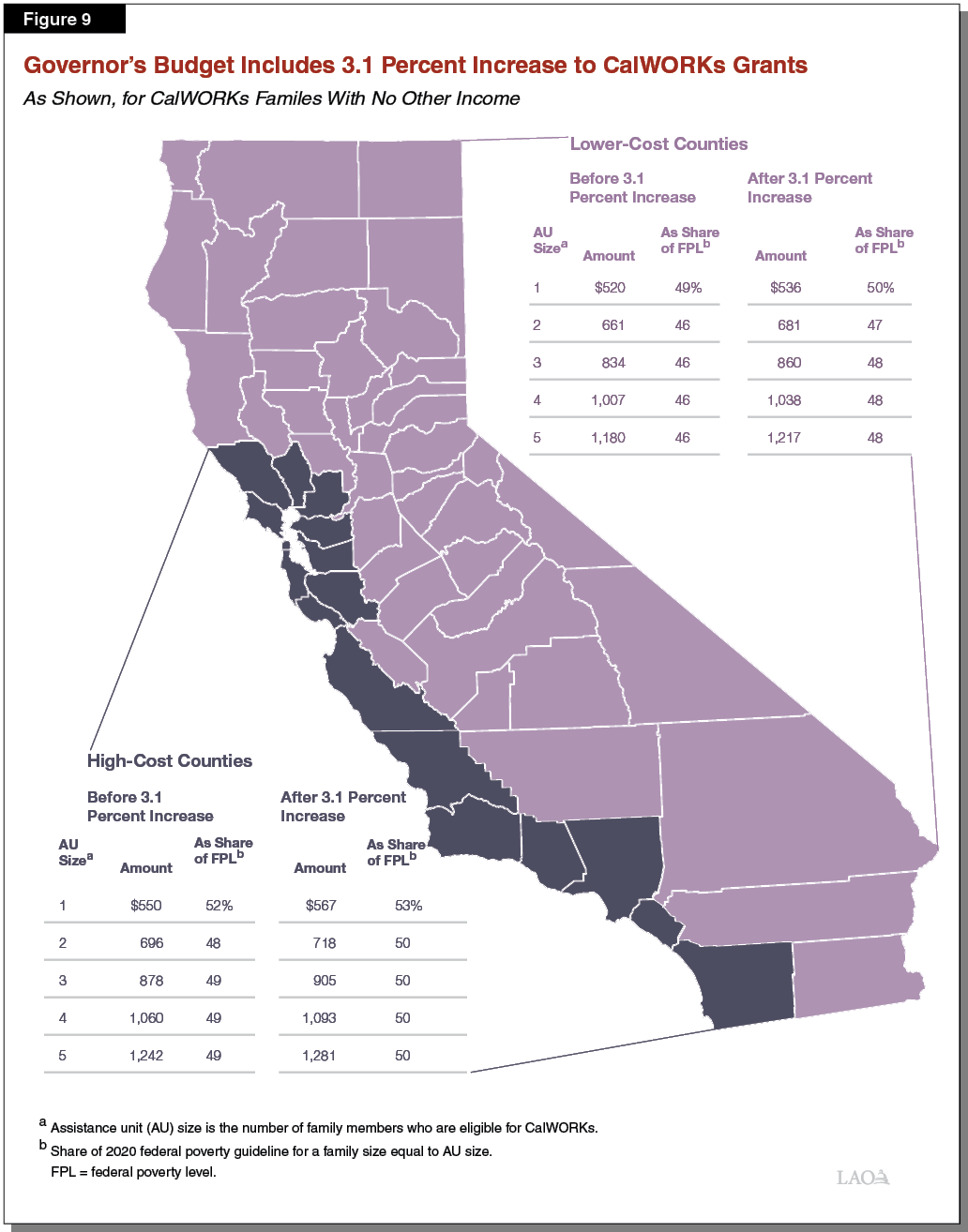

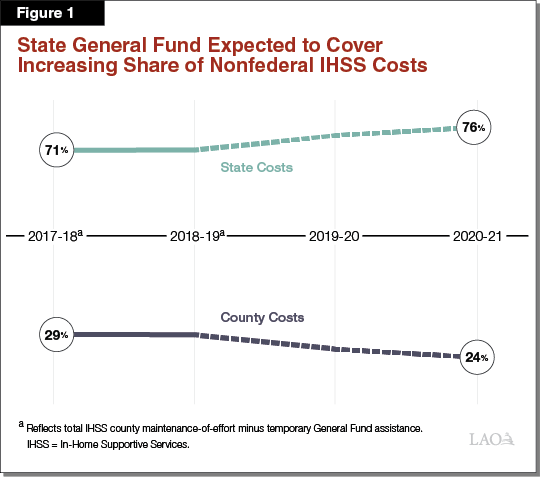

The 2020 21 Budget Department Of Social Services

Used Whatsminer M21s 50t Or Miner M21s 52t Sha256 Miner Asic Btc Bch Bcc Mining Machine In 2021 Real Estate Investment Group Bitcoin Price Orange County Real Estate

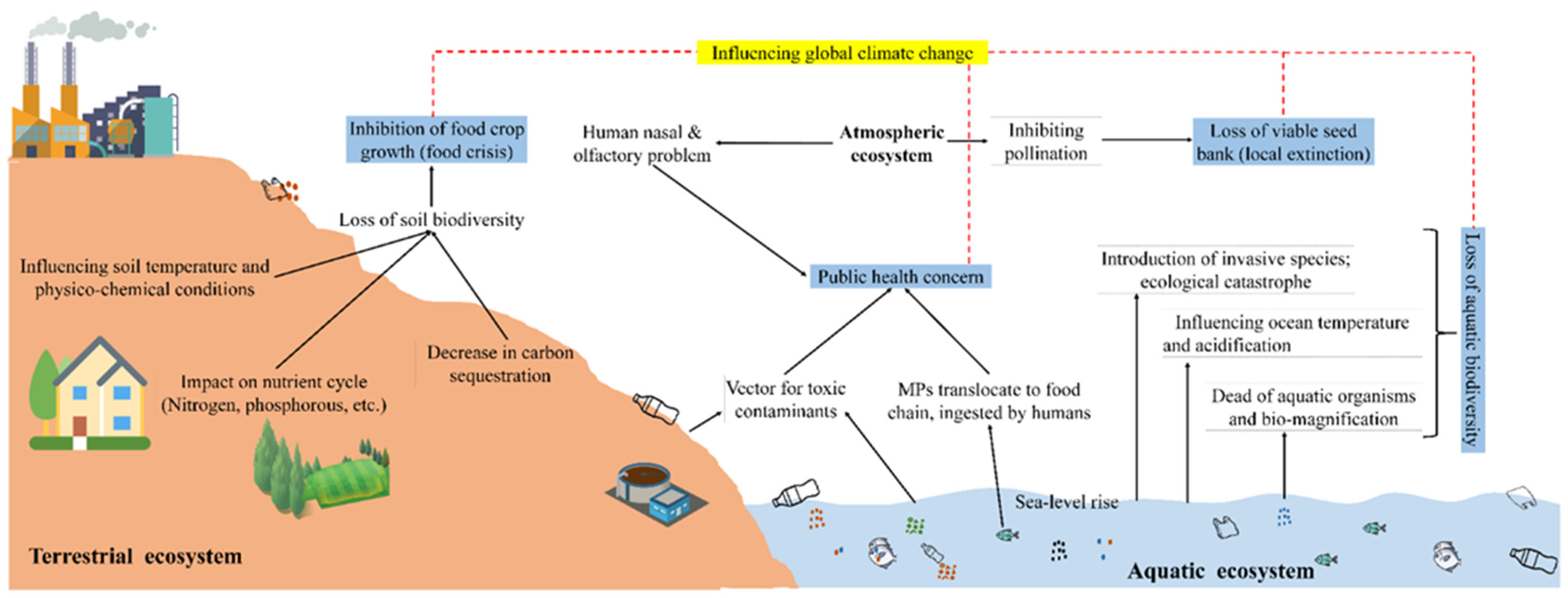

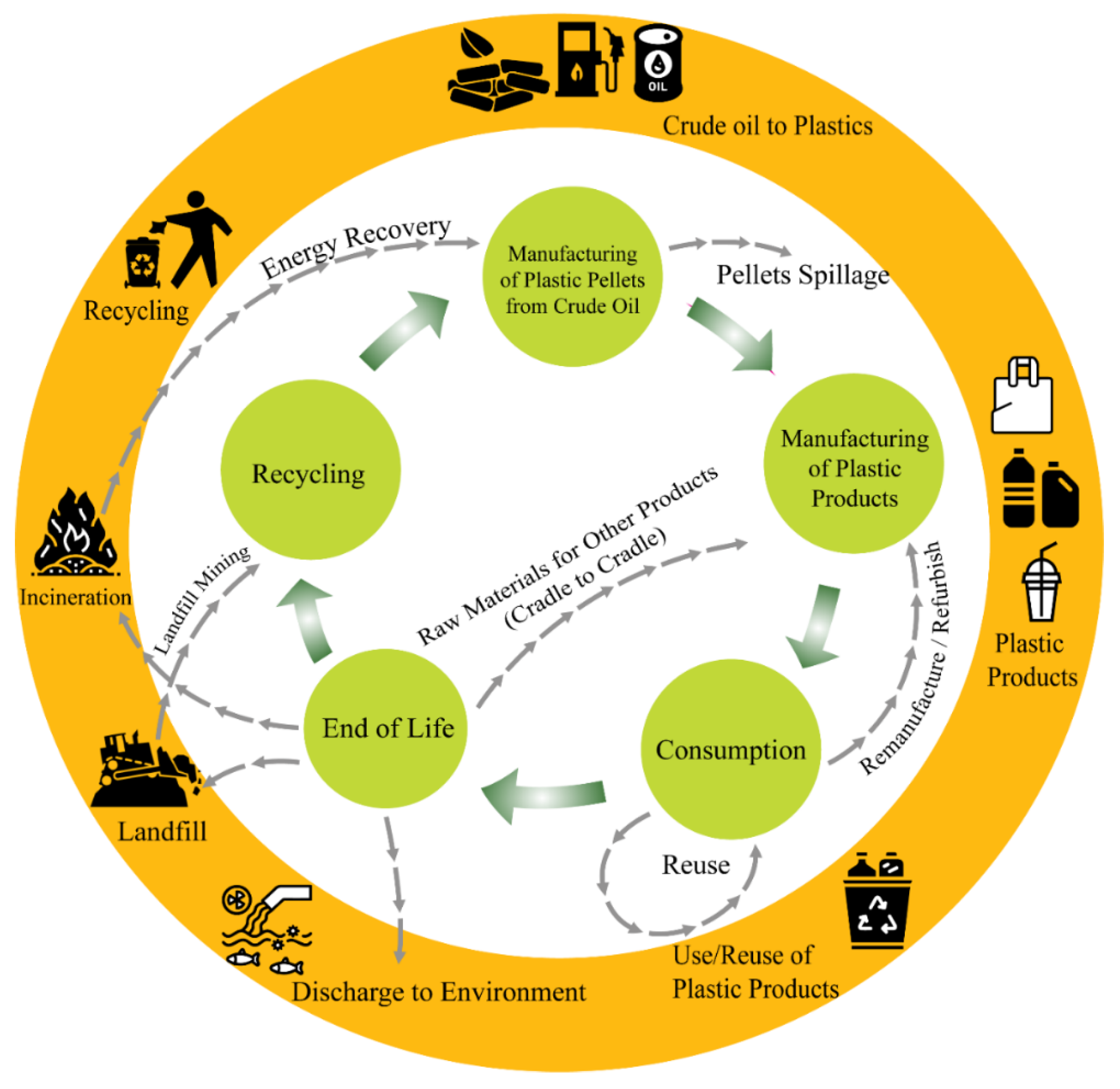

Sustainability Free Full Text Impacts Of Plastic Pollution On Ecosystem Services Sustainable Development Goals And Need To Focus On Circular Economy And Policy Interventions Html

Used Whatsminer M21s 50t Or Miner M21s 52t Sha256 Miner Asic Btc Bch Bcc Mining Machine In 2021 Real Estate Investment Group Bitcoin Price Orange County Real Estate

How To Select The Real Estate Appraiser Real Estate Real Estate Photography Home Buying

/GettyImages-6034-000797-38dfc99517fa46fcae80718888454e3b.jpg)

Inflation Vs Deflation What S The Difference

Property Taxes Department Of Tax And Collections County Of Santa Clara

Sustainability Free Full Text Impacts Of Plastic Pollution On Ecosystem Services Sustainable Development Goals And Need To Focus On Circular Economy And Policy Interventions Html

Risk Rating 2 0 A First Look At Fema S New Flood Insurance System California Waterblog

Used Whatsminer M21s 50t Or Miner M21s 52t Sha256 Miner Asic Btc Bch Bcc Mining Machine In 2021 Real Estate Investment Group Bitcoin Price Orange County Real Estate

Risk Rating 2 0 A First Look At Fema S New Flood Insurance System California Waterblog

The 2020 21 Budget Department Of Social Services

Redefining Bad Debt Expense The Medicare Reimbursement Implications Bkd

East Bay Municipal Utility District Customers Could See Increase In Water Bills In The Middle Of A Drought Abc7 San Francisco

Report International Conference On Inclusive Insurance 2020 Digital Edition

Sustainability Free Full Text Impacts Of Plastic Pollution On Ecosystem Services Sustainable Development Goals And Need To Focus On Circular Economy And Policy Interventions Html